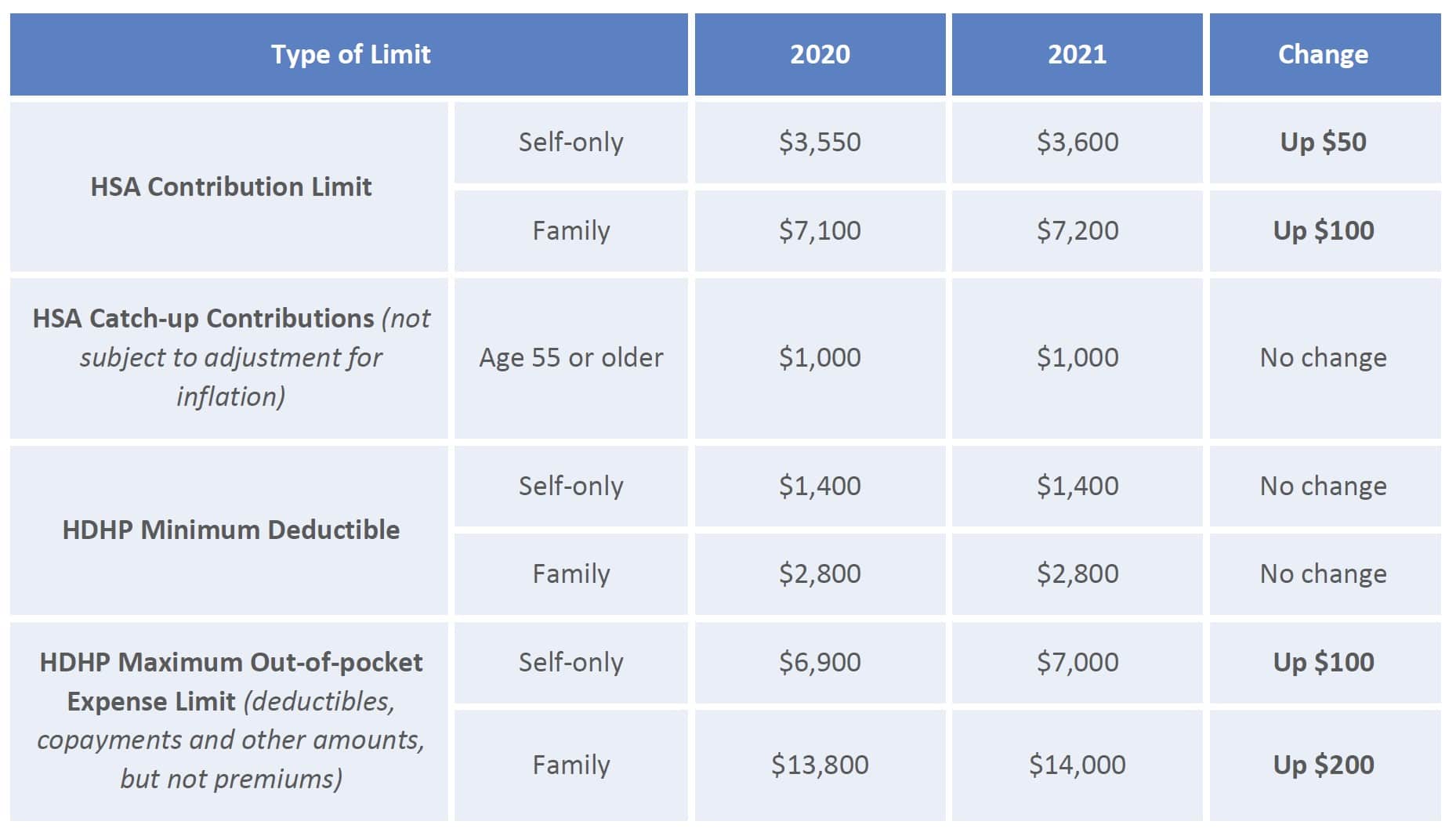

Also, unlike IRAs or other tax-deferred accounts, there are no income threshold limits. And guess what? Whether you use that money in the current year – it doesn’t matter- If you don’t use it, you don’t lose it. For family coverage, the maximum contribution for 2021 is $7200, but will rise to $7300 in 2022. Here’s the really important federal tax benefit you need to know: just like FSA accounts, contributions to HSA accounts are tax deductible but allow for much higher deposits! For 2021, the maximum contribution to the HSA is $3600 and will rise to $3650 in 2022. While the rules are typically subject to change annually, for 2022 the minimum deductible rules for singles and family plans will remain the same. For 2021, the health plan deductible for singles, must be at least $1400 and $2800 for family coverages. Unlike FSAs, HSAs are only available in conjunction with a qualified HDHPs (High Deductible Health Plans). Both are funded with pre-tax contributions, funds can be withdrawn tax-free to cover qualified medical expenses, and your employer can provide a match-but that’s where the similarities end.

While there are some common features, they are in fact very different kinds of accounts.

A lot of people think Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) are about the same or are not aware of HSA accounts.

0 kommentar(er)

0 kommentar(er)